The Fed Setup: Decentralization & Board of Governors

The Federal Reserve System was established in 1913 when Congress passed the Federal Reserve Act. Although the Fed is independent of the government, it is ultimately accountable to Congress because Congress can amend the Federal Reserve Act at any time. Its actions, however, do not require any kind of approval from the government.

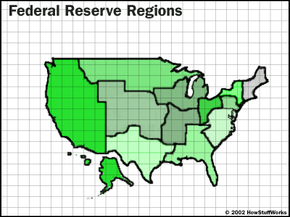

The Fed is called a "decentralized" central bank, which in itself seems to be a contradiction. It works, however, because the Fed is uniquely structured to eliminate government control but still remains accountable to both the government and the public. The Board represents the interests on the government side, and the regional Reserve Banks (whose boards of directors consist of local citizens) represent the interests of the private side. In order to operate independently of the government, the Fed finances its own operations.

Advertisement

The Board of Governors

The Fed has a seven-member Board of Governors and 12 regional Reserve Banks. The U.S. president appoints (and the Senate confirms) the seven Governors, whose 14-year terms are staggered to prevent a single president from being able to appoint too many governors. The chairman of the Federal Reserve, who serves a four-year term, is also appointed by the president.