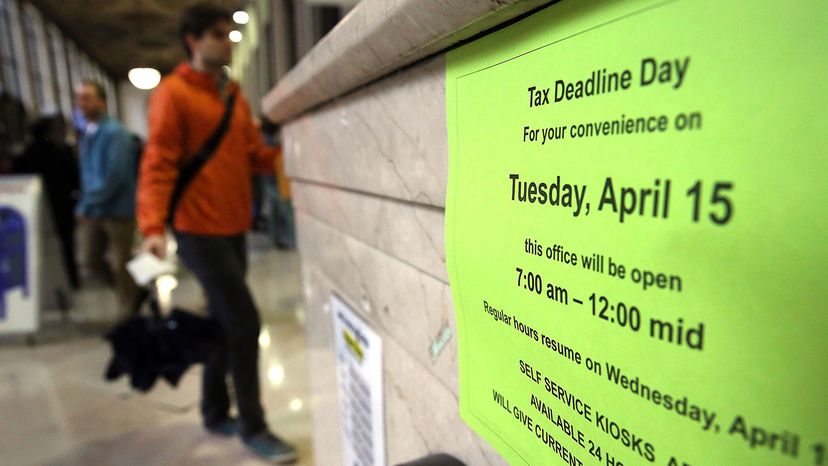

When I think about taxes one of the first things that comes to mind is those old TV shows where the dad is up to his eyeballs in a mess of paperwork. We see calculators strewn across the table and endless trails of paper tape as he desperately tries to sort out his taxes in time for April 15.

This scenario doesn't really happen anymore, thanks to tax filing software, accountants and computer files. So while filing taxes isn't exactly the most fun thing to do, it's certainly not as stressful as it used to be.

Advertisement

However, there is one part of the tax process that causes many people to still wake up in a cold sweat in the middle of the night: tax audits.

Cue scenes of auditors slapping some handcuffs on you and taking you off to jail.

In reality, that's unlikely to happen. There aren't any debtors' prisons in the U.S. But what could happen to you? And how does the IRS know who to go after?

It doesn't help that the IRS is pretty tight-lipped about its tax auditing process. Can you really blame the agency? Why would it give away the playbook?

The good news is there is more information available than ever before. In the next 10 pages, we'll separate fact from fiction to help calm your nerves about potentially being audited. Let's start with the most obvious myth.