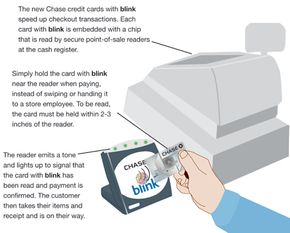

Credit cards using blink technology employ RFID. There are many forms of RFID. For example, Wal-Mart has experimented with putting RFID chips on their merchandise so they can track inventory automatically (see How RFID Works).

Blink uses a specific kind of RFID developed under International Standard 14443. ISO 14443 has certain features that make it particularly well-suited to applications involving sensitive information, such as credit-card account numbers:

- Data transmitted by ISO 14443 chips is encrypted.

- The transmission range is designed to be very short, about 4 inches (10 cm) or less.

As a result, ISO 14443 is used in more than 80 percent of contactless credit-card transactions worldwide [ref]. Recent additions to the standard allow ISO 14443 technology to store biometric data such as fingerprints and face photos for use in passports and other security documents.

To understand how the contactless card and terminal work together, first we have to talk about induction. In 1831, it was already known that an electric current produced a magnetic field. That year, Michael Faraday discovered that it worked the other way around as well -- a magnetic field could produce an electric current in wires that passed through the field. He called this induction, and the law that governs it is known as Faraday's Law.

In some cases, induction is something electrical engineers try to avoid. For instance, if the electric lines in your neighborhood run too close to the phone lines, the magnetic field produced by the electric lines can generate voltage in the phone lines. This voltage shows up as "noise" in the signal passing through the phone lines. Shielding and proper orientation of the lines can prevent this interference.

For RFID devices such as blink cards, engineers have harnessed induction. Each blink card contains a small microchip as well as a wire loop. The blink terminal gives off a magnetic field in the area around it. When a blink card gets close enough, the wire loop enters the terminal's field, causing induction. The voltage generated by the induction powers the microchip. Without this process, called inductive coupling, each blink card would have to carry its own power supply in the form of a battery, which would add bulk and weight and could eventually run out of power. Because the power is supplied by the terminal, the blink system is known as a passive system.

Once the blink card has power flowing to it from the terminal, the processor then transmits information to the terminal at a frequency of 13.56 MHz. This frequency was chosen for its suitability for inductive coupling, it's resistance to environmental interference and its low absorption rate by human tissue [ref]. Instruction sets built into the processor encrypt the data during transmission.

In the next section, we'll see if blink users need to be worried about security.