The Federal Reserve and Interest

When the chair of the United States Federal Reserve talks about interest rates, the whole world listens. A slight, quarter-point adjustment in the Fed's fund rate is enough to send international stock markets soaring or plummeting. But what is this institution that carries so much financial weight?

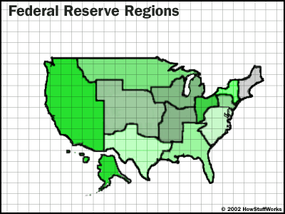

The Federal Reserve is the central bank of the United States. It's made up of 12 regional Federal Reserve banks overseen by a seven-member board of governors in Washington, D.C. Created by Congress in 1913, the Federal Reserve system was designed to give more stability and security to the nation's economy, which was recovering from a run of "banking panics" [source: Federal Reserve Education].

Advertisement

The Federal Reserve walks the line between a public and private institution. The U.S. Treasury uses the Federal Reserve to raise money for the government through the selling of government bonds and other securities to domestic and foreign investors.

The Federal Reserve also helps supply U.S. commercial banks with cash reserves. By law, banks must hold a certain amount of cash in reserves to avoid unexpected "cash outflows," such as many people trying to take money out of their accounts at once. The Federal Reserve sets the interest rates by which banks lend each other money and a separate interest rate for borrowing money directly from the Fed.

The stated economic goals of the Fed are maximum employment, stable prices and moderate long-term interest rates. To achieve these goals, the Fed uses something called monetary policy: a set of complicated, carefully calculated decisions based on the state of the domestic and international economy. The Fed closely monitors key economic indicators to predict future trends and influence them in the right direction. The overall goal is to keep inflation in check while enabling the GDP (gross domestic product) to grow at a steady pace [source: Federal Reserve Education].

Interest rates are one of the Fed's most powerful tools for implementing monetary policy. The Fed sets several key interest rates that influence borrowing and lending across the economic spectrum. The first is the federal funds rate, which is the interest rate that one bank charges to another for borrowing cash reserves. It's calculated according to basic laws of supply and demand. The more money banks have in reserves, the lower the rate. The more demand for loans, the higher the rate.

The interesting part is that the Fed controls the supply and demand. If the Fed wants to lower the funds rate, it buys securities from banks, injecting more cash into their reserves. If the Fed wants to raise the funds rate, it sells government securities back to the banks, lowering their cash reserves. This tinkering with supply and demand is called open market operations, another tool of monetary policy [source: FRBSF].

The discount rate is another interest rate set by the Fed. This is the rate by which banks can borrow money directly from the Fed. The discount rate covers very short-term loans, usually overnight and is higher than the funds rate, because the Fed encourages banks to borrow from each other first. Within the discount rate are three tiers: primary rate, secondary rate and seasonal rate. The primary rate is the lowest and given to financial institutions in good standing. The secondary rate is for slightly less sound institutions, and the seasonal rate is offered to smaller banks in seasonally unbalanced economies, like agriculture or tourism [source: The Federal Reserve].

Now let's talk about how and why the Fed's interest rate adjustments affect the economy as a whole.