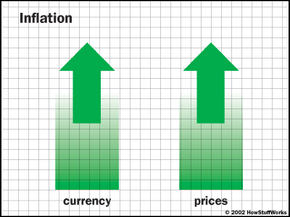

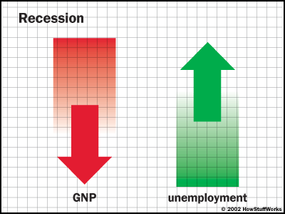

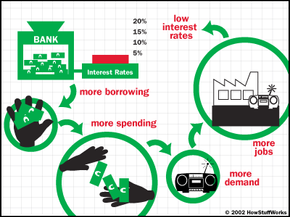

The most important job the Fed has is to manage the nation's money and the overall economy. Controlling the inflation rate and maintaining employment and production aren't easy tasks. The Fed has to have some pretty hefty tools up its sleeve in order to influence the economy of an entire country -- especially one the size of the United States. The Fed has to be able to affect the rate at which consumer banks and financial institutions create "checkbook" money for customers through the loans they grant and investments they offer. They do this by influencing short-term interest rates and the amount of money in circulation.

But how does it do that? The Fed uses three tools:

- The reserve requirement

- The discount rate

- Open market operations

The Reserve Requirement

In order to combat the problems of insufficient cash reserves (and the inability to pay depositors) that were faced before the creation of the Federal Reserve System, banks now have to set aside a certain amount of cash in "reserve." The reserve balance that banks must maintain is typically a percentage of their total interest-bearing and non-interest-bearing checking account deposits (currently 3% to 10%). In other words, the amount of a bank's required reserves will fluctuate depending on their account totals. The reserve is very important because it helps to ensure that the bank will always be able to give you your money when you ask for it.

This percentage of required reserves directly affects how much money they can "create" in their local economies through loans and investments. It is this connection between the required reserve amount and the amount of money a bank can lend that allows the Fed to influence the economy. If the reserve requirement is raised, then banks have less money to loan and this will have a restraining effect on the money supply. If the reserve requirement is lowered, then banks have more money to loan.

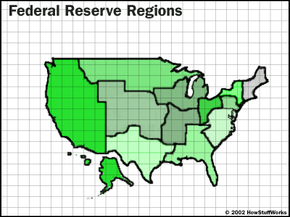

Reserve money is used to process check and electronic payments through the Federal Reserve and to meet unexpected cash outflows. These reserves can be held as "cash on hand," as a reserve balance at a regional Reserve Bank, or both.

Although the Fed has the power to do so, changing the amount of reserve cash a bank has to have can have dramatic effects on the economy; for this reason, this tool is rarely used. The Fed more often alters the supply of reserves available by buying and selling securities. When the Fed sells securities, it reduces the banks' supply of reserves. This makes interest rates go up. When the Fed buys securities, it increases the banks' supply of reserves. This makes interest rates go down.

All of this buying and selling is referred to as open market operations (discussed below).

In the event that a bank's money supply drops below the required reserve amount, that bank can borrow either from another bank or from a Reserve Bank. If it borrows from another bank's excess reserves, then the loan takes place in a private financial market called the federal funds market. The federal funds market interest rate, called the funds rate, adjusts according to the supply of and demand for reserves.

If a bank chooses to borrow emergency reserve funds from a Reserve Bank, then it pays an interest rate called the discount rate.