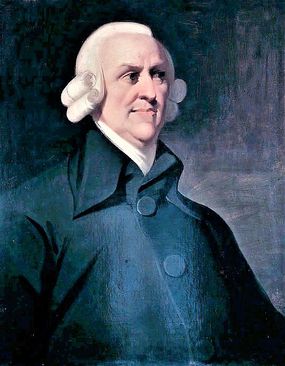

Smith's free-market ideas were embraced in the fledgling United States, which had waged a revolution not only for political freedom, but economic freedom. Founding Fathers like James Madison and Alexander Hamilton believed that the most efficient and productive economy would protect the liberties of private citizens against interference from despotic kings or meddling bureaucrats.

But like Smith, America's founders were not blind to the limits of laissez-faire. They understood that humans, when left free to pursue their self-interest, may start to infringe on the liberties of others. In that case, the government has a duty to step in and take more of an active role.

Over its nearly 250-year history, the United States has lived through periods of unfettered free-market capitalism and also of boldly interventionist government regulation. The debate over the ideal role of government in the economy remains a fiercely dividing political issue.

America's love affair with laissez-faire reached its peak in the 1870s as the United States economy was going through rapid industrialization. New railroads, factories and mining operations enabled the efficient conversion of natural resources into commercial goods. The first corporations were born and earned massive profits for industrialist entrepreneurs.

But it wasn't long before those same wealthy industrialists banded together to form anticompetitive monopolies to fix prices, and exploited their workers (including children) through unsafe and unsanitary working conditions. In response, there was a shift away from pure laissez-faire economic policy and toward "trust-busting" and labor regulations.

A similar policy reversal happened in the 1920s and 1930s. During the boom economy of the "roaring twenties," Republican presidents Warren Harding and Calvin Coolidge held firm to a laissez-faire, do-nothing economic policy that allowed businesses to maximize profit. After the 1929 stock market crash, fellow Republican Herbert Hoover tried to temper his predecessor's laissez-faire stance, but it was too late. Franklin D. Roosevelt New Deal policies represented a 180-degree shift toward active intervention, big-government social programs and economic stimulus measures.