Recessions bring anxiety and fear, not to mention financial disaster for many. Just what does "recession" mean, and how do people cope?

Advertisement

The 2008 recession had global effects. An Indian stock dealer copes with news that Indian share prices fell 6 percent. But what does the word "recession" really mean?

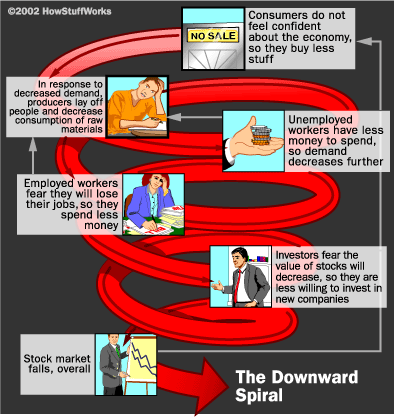

Periodic recessions are a natural part of any nation's economic cycle. See what the upswing looks like next.

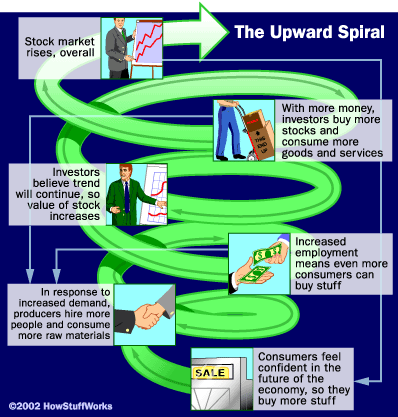

Eventually, things will turn around. All economic downturns are different -- let's look at what happened in the most recent collapse.

Problems began when the subprime mortgage industry collapsed in late 2007. Thousands of homeowners were priced out of their mortgages as interest rates skyrocketed. Then the banks faltered.

Advertisement

Indymac was the first of many banks to close its doors. The real estate collapse affected the banking industry that provided mortgage loans, and before long, bank closings took over the headlines. As credit dried up and new construction slowed, unemployment rates spiked.

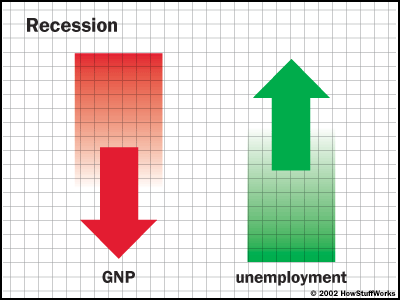

Some economists define a recession as two consecutive quarters in which the gross domestic product (GDP) decreases. Unemployment often rises as this occurs. And when people are unemployed, they're unable to pay their debts.

Many consumers felt trapped by credit card companies, who raised interest rates and lowered credit limits. Then, fuel prices exploded.

Gas prices approached $4 per gallon in May 2008 -- if your local station had any, that is. Meanwhile, the federal government scrambled to find solutions.

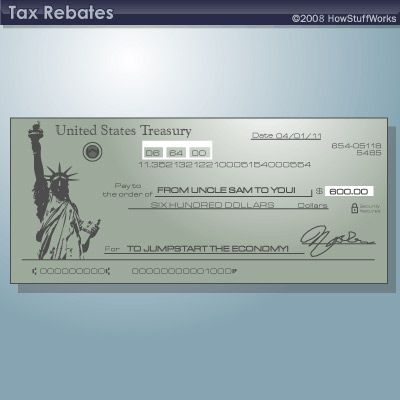

Federal Reserve Chairman Ben Bernanke ponders the state of the U.S. economy. See one tactic the government used to jump-start the economy, next.

Advertisement

Tax payers got a break from the IRS in 2008 and 2009. The logic behind tax rebates is that a jolt of consumer spending can trigger economic growth. So, did it work?

Not really. Consumers didn't spend as much as some hoped or expected during the 2008 holiday season. Instead, financing plans like layaway made a comeback, as shoppers tried to avoid debt. See how department stores can help economists track economic progress, next.

The "hemline index" and "lipstick indicator" are two ways retailers (and even some economists) try to gauge consumer confidence. The theories claim that hemlines rise and fall with the economy and that women buy more lipstick and avoid bigger purchases when times are tight. But enough of shopping -- see the political response to government bailouts next.

While economists debated the necessity of bailing out the banks, ordinary citizens took to the streets to protest a proposed $700 billion in federal bailouts of investment banks and mortgage buyers. See who else incited protest next.

Citizens take aim at predatory lending and credit card practices. Meanwhile, as the recession dragged on, the presidential election heated up.

Advertisement

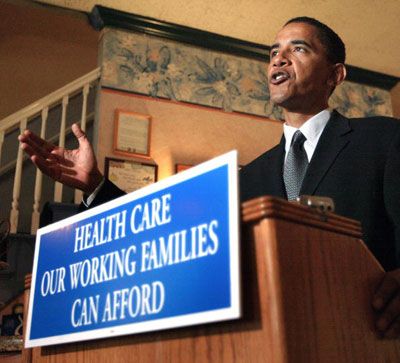

Illinois Senator Barack Obama unveiled a plan to help small business owners provide health insurance for their employees. See another issue crucial to Obama's campaign plan in the following picture.

Barack Obama addresses the League of Conservation Voters Environmental Victory Rally in 2004. By the 2008 election, clean energy was a top priority in Obama's plan to create jobs and reduce dependence on foreign oil. Among the many tasks before him in the White House was a closer look at the credit industry.

By early 2009, consumer outrage, economic turmoil and credit defaults prompted President Obama to enact restrictions on some questionable credit card practices. Meanwhile, communities banded together to help each other survive hard times.

Community gardens sprung up all across the country as food and energy costs soared. See how else people are making positive changes in the last image.

In many ways, the recession has promoted "green" living, as consumers convert to energy-saving products to help conserve cash. For more information on coping with the recession, read 5 Ways to Stay Upbeat in a Down Economy.

Advertisement