If your business is in one of those "sexy" industries (high-tech or something very innovative), and you need large amounts of capital to get it going quickly, you should think about finding investors such as angels and venture capitalists (VCs). With this type of capital, you can sometimes obtain large quantities of money, and this money can help businesses with big start-up expenses or businesses that want to grow very quickly. VC firms typically won't invest less than $250,000. Attracting the attention of angels and VCs is pretty difficult. It takes a lot of networking and a lot of plain old hard work.

Angel investors are simply wealthy people who operate in a similar manner as VCs, but independently rather than with a firm. They usually invest less than $200,000 and stick to new businesses within their own geographical region. They are called "angels" because they usually aren't interested in controlling your company, but simply acting as a mentor. It is speculated that angels account for the largest source of start-up capital for new business, but their ventures are more informal and private.

Venture capitalists fund all sorts of businesses. The classic approach is for a venture-capital firm to open a fund. A fund is a pool of money that the VC firm will invest. The firm gathers money from wealthy individuals and from companies, pension funds, etc., that have money they wish to invest. A VC firm will raise a fixed amount of money in the fund -- for example, $100 million.

The VC firm will then invest the $100 million fund in some number of companies -- for example, 10 to 20 companies. Each firm and fund has an investment profile. For example, a fund might invest in biotech start-ups. Or the fund might invest in dot-coms seeking their second round of financing. Or the fund might try a mix of companies that are all preparing to do an IPO (initial public offering) in the next six months. The profile that the fund chooses has certain risks and rewards that the investors know about when they invest the money.

Typically, the venture-capital firm will invest the fund and then anticipate that all of the investments it made will liquidate in three to seven years. That is, the VC firm expects each of the companies it invested in to either "go public" (meaning that the company sells shares on a stock exchange) or be bought (acquired) by another company within three to seven years. In either case, the cash that flows in from the sale of stock to the public or to an acquirer lets the VC firm cash out and place the proceeds back into the fund. When the whole process is done, the goal is to have made more money than the $100 million originally invested. The fund is then distributed back to the investors based on the percentage each one originally contributed.

Let's say that a VC fund invests $100 million in 10 companies ($10 million each). Some of those companies will fail. Some will not really go anywhere. But some will actually go public. When a company goes public, it is often worth hundreds of millions of dollars. So the VC fund makes a very good return. For one $10 million investment, the fund might receive back $50 million over a five-year period. So the VC fund is playing the law of averages, hoping that the big wins (the companies that make it and go public) overshadow the failures and provide a great return on the $100 million originally collected by the fund. The skill of the firm in picking its investments and timing those investments is a big factor in the fund's return. Investors are typically looking for something like a 20% per year return on investment for the fund.

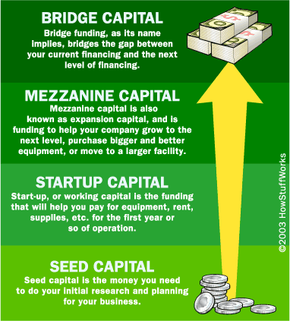

From a company's standpoint, here is how the whole transaction looks. The company starts up and needs money to grow. The company seeks venture-capital firms to invest in the company. The founders of the company create a business plan that shows what they plan to do and what they think will happen to the company over time (how fast it will grow, how much money it will make, etc.). The VC firm looks at the plan, and if it likes what it sees, it invests money in the company. The first round of money is called a seed round. Over time, a company will typically receive three or four rounds of funding before going public or being acquired.

In return for the money it receives, the company gives the VC firm stock in the company, as well as some control over the decisions the company makes. The company, for example, might give the VC firm a seat on its board of directors. The company might agree not to spend more than $X without the VC's approval. The VC might also need to approve certain people who are hired, loans, etc.

In many cases, a VC firm offers more than just money. For example, it might have good contacts in the industry or it might have a lot of experience it can provide to the company.

One big negotiating point that is discussed when a VC invests money in a company is, "How much stock should the VC firm get in return for the money it invests?" This question is answered by choosing a valuation for the company. The VC firm and the people in the company have to agree on how much the company is worth. This is the pre-money valuation of the company. Then, the VC firm invests the money, and this creates a post-money valuation. The percentage increase in the value determines how much stock the VC firm receives. A VC firm might typically receive anywhere from 10% to 50% of the company in return for its investment. More or less is possible, but that's a typical range. The original shareholders are diluted in the process. The shareholders own 100% of the company prior to the VC's investment. If the VC firm gets 50% of the company, then the original shareholders own the remaining 50%.

Dot-coms typically use venture capital to start up because they need lots of cash for advertising, equipment, and employees. They need to advertise in order to attract visitors, and they need equipment and employees to create the site. The amount of advertising money needed and the speed of change in the Internet can make bootstrapping impossible. For example, many of the e-commerce dot-coms typically consume $50 million to $100 million to get to the point where they can go public. Up to half of that money can be spent on advertising!

As in many aspects of life, finding a VC is less about your skills or who you are, and more about who you know. Networking has never been more important. To find a VC, you have to use every contact you have. Never miss an opportunity to get a name. You have friends and your friends have friends. Your business associates, attorney, accountant, banker, they all have connections -- use them. Follow up every lead. Go to every function that VCs attend. Work every room. Keep notes, make lists and use them frequently. Find angel and VC organizations and/or associations. Use the Internet. Do whatever it takes to get the names, and then contact them.

Next, how to present your idea.