Personal Income Taxes

Taxes are inevitable, but if you are educated, you can soften their impact. Learn about tax and money organization, income taxes and other topics in the Taxes channel.

5 Common Auto Insurance Scams (And How to Avoid Them)

How Auto Insurance Companies Work

How does the color of your car affect your insurance rate?

What Are the Different Types of Life Insurance?

Do I Need Life Insurance?

10 Factors That Affect Your Life Insurance Premium

How to Fill Out a Money Order

How to Write a Check

How to Find Your Bank's Routing Number

Motel vs. Hotel: Differences in Overnight Accommodations

10 Things Hotels Don't Want You to Know

How Family Road Trips Can Be Done on the Cheap

7 Best Chrome Extensions for Finding Coupons in 2023

8 Cheapest States to Live In

How Black Friday Became Big Business Around the World

Can you use student loans to buy a used car?

Top 10 Things to Steal from Your Parents' House

What to Do When a Friend Owes You Money

How to Future-proof Your Child's Credit From Fraud

How to Avoid Being Evicted From Your Home

8 Most Expensive Things in the World, From Parking to Palaces

Where Should You Put Your Money When Inflation Is High?

What Is Probate and Can You Avoid It?

How Square Works

5 Ways Mobile Banking Alerts Can Benefit You

Is it safe to shop online with a debit card?

What's the Difference Between Student Loan Refinance and Student Loan Consolidation?

Is It a Good Idea to Refinance Your Student Loans?

10 Reasons College Costs So Much

5 Reasons You Might Need to Visit the Social Security Office

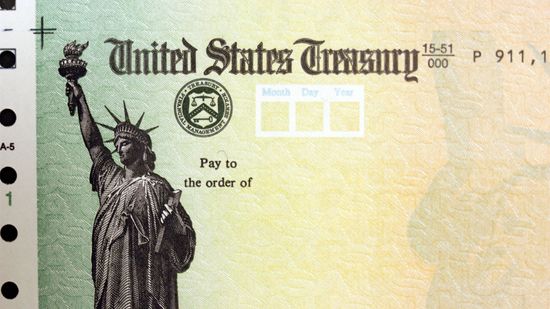

Who Decides When Your Social Security Check Increases?

These Folks Retired in their 30s and 40s: Can You Do It Too?

Learn More / Page 3

Many people who benefit from the Affordable Care Act also have to do some financial juggling pay their monthly premiums. But a tax credit can help. Find out how they make the Affordable Care Act, well, affordable.

How does the federal government provide a financial incentive to businesses to hire groups who have historically found it difficult to find full-time work? Through the work opportunity tax credit.

By Susan Sherwood

Special tax credits are available to people with disabilities as well as to those who care for them. Let's explore them.

By Susan Sherwood

Advertisement

We're all looking for ways to reduce the amount of money we give to Uncle Sam. Did you know there's a way to do that and save for retirement at the same time? Find out how putting money in a (401)k can reduce your tax bill.

Your honeymoon's barely over, and it's already time to file your taxes. You heard filing jointly had great perks, but will you and your beloved still benefit since you haven't even been married a year?

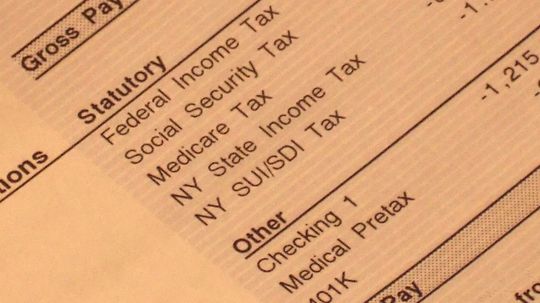

One perk of being employed (as opposed to being an independent contractor) is that your company pays half of your Federal Insurance Contributions Act tax. No clue what FICA is? It accounts for a big chunk of your federal income taxes.

You're about to tie the knot and your fiancé drops a bombshell. He owes a hefty sum in back taxes to the IRS. Now what? Will his bill become yours after you say your "I do's"?

Advertisement

Private school has a number of benefits. But what about when it comes to tax day? What is the IRS doing to help ease the cost of your child's education?

Bankruptcy is difficult enough to deal with by itself. But then adding the drudgery of figuring out how it will affect your tax return can make your situation feel hopeless. But it's not. Your options depend on the form of bankruptcy you filed under.

You both pay the bills. You both keep a home. You both raise the kids. Does the IRS consider you both heads of households?

Mega Millions and the Powerball lotteries have collectively hit over $1 billion. But if you happen to win one (or both) how much will Uncle Sam want?

Advertisement

If you make money from the stock market, the IRS is interested in that – they get a cut. How do you determine what you owe them?

By Susan Sherwood

You might be tempted to pay less than you owe on taxes throughout the year and make up the difference at tax time. Unfortunately, the IRS does not agree with that tactic and may sock you with a penalty.

By Susan Sherwood

The IRS recognizes five types of business: sole proprietorship, partnership, C corporation, S corporation and limited liability company. Which one should you choose?

By Susan Sherwood

An IRS audit is treated on TV with the same dread as hearing Bigfoot in the forest. But an audit doesn't always spell doom and gloom and we'll tell you why. We can't speak for Bigfoot, though.

Advertisement

Considering the mental gymnastics some of us get into when it comes to write-offs, filing our taxes could qualify as an Olympic sport. Fortunately, the IRS offers quite a few common -- and even convenient -- deductions to help save us the trouble.

Residual — or passive — income is the kind of money generated while you're busy doing other things. Find out what passive income is and how you're supposed to pay taxes on it.

Figuring out what qualifies as a work-related travel expense can be tricky when you're in a war zone. What other challenges do active duty military personnel face at filing time?

By Julia Layton

Not only U.S. citizens and legal residents are required to file federal income tax forms. Nonresident aliens have to do so as well. These have their own special exemptions.

By Dave Roos

Advertisement

Do you suspect someone of cheating on their taxes? You can report it to the IRS and perhaps even receive a reward. But just be sure you know what you're talking about – and be prepared to wait.

Just landed your first "real job" with a W-2 form and a health plan? If so, you might be confused about what to do at tax time. Here's a beginner's guide to satisfying the tax man.

By Chris Opfer

Whether you call it an estate tax or a death tax likely depends on your point of view: Is it a tax that benefits society or penalizes the wealthy? Whatever your opinion, learn more about the evolution of this controversial tax.

By Jane McGrath

Don't spend all the money you received in a settlement just yet; you probably have to pay taxes on it.

By Debra Ronca

Advertisement

The history of the landmark U.S. Affordable Care Act is still being written as you read this, but the larger issue of health care reform has been riling up people for decades. Ready to hit some highlights?

Losing a spouse can provide financial, as well as emotional, challenges, but if he or she was getting Social Security benefits, that money may keep coming to you.

By Debra Ronca