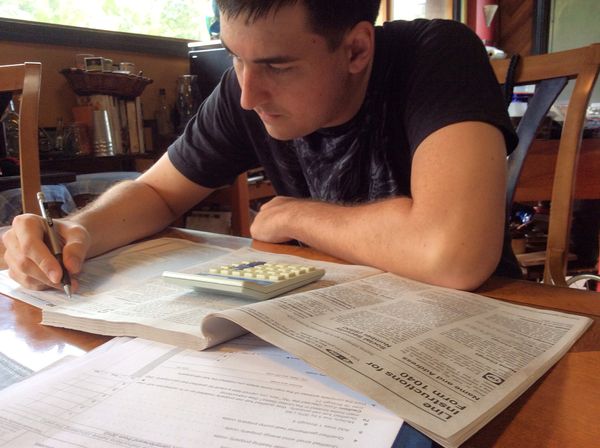

Tax season. For some, it brings to mind images of late nights tapping on the calculator papers scattered all over the dining room table. Or the last-minute rush to find the correct forms and the frustration of trying to calculate expenses and deductions. And finally, after double- and triple-checking all your work, signing all the papers, and dropping the whole shebang in the mail, you wait weeks and weeks for that much-needed return to come back. Ah, the bad old days, right?

Today that process is a whole lot easier, thanks to technology. Gone are the days of complicated paperwork, math, and waiting forever for a refund. You can use your computer to electronically file (e-file) your taxes with the IRS, and the entire process is streamlined, efficient, and less prone to errors. Plus, your refund arrives much more quickly; it can be directly deposited to your bank account if you choose. Another perk is that you can track your refund.

Advertisement

In 2013, over 43 million people directly filed their taxes via e-file, over 70 million tax professionals used e-filed taxes for their clients too [source: Bell]. Here's how it works.