There's nothing quite like the excitement and pride of receiving your very first paycheck. You worked hard for a solid month, and here's your much-deserved compensation. But wait a second ... what's the story with this line that says "net pay?" That can't be your actual salary, could it? What happened to all of your money? By the time you get your paycheck, it's been cut up like a pizza, with several government agencies taking a piece of the pie. Exactly how much money is withheld from each check varies from person to person, company to company and state to state. However, almost every income earner has to pay federal income tax.

We generally don't think much about taxes except during the annual tax season. It's probably the most dreaded time of the year for millions of Americans, yet we circle it on our calendars, along with holidays and birthdays. But little joy is connected to April 15, the deadline for filing tax forms. (This deadline doesn't always fall on the 15th. In 2012, Tax Day was Tuesday, April 17 because the 15th was a Sunday and the 16th was a holiday in Washington, D.C. [source: Kaufman].)

Advertisement

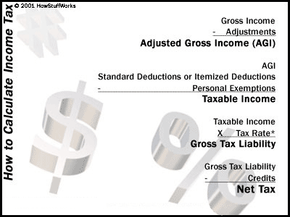

The American tax system is a huge machine with a tax code that seems more complex than rocket science. In this article, we will examine how individual income taxes work, take a look at the history of income taxes in the United States and consider two alternative tax plans.

Advertisement