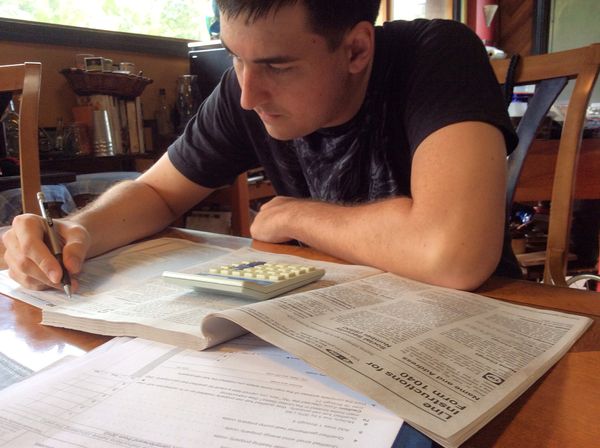

The U.S. tax system has its haters. More than two-thirds of Americans say they dislike or hate doing their taxes. A majority of us complain that our taxes are too high and that the wealthiest among us don't pay their fair share. Without a top-notch accounting team, it's easy to feel taken advantage of. Maybe that's why nearly 60 percent of Americans say the tax system should be completely overhauled [source: Drake].

What's the alternative? A growing number of economists, politicians, tax policy experts and public figures, including billionaire Bill Gates, say it's time to abolish income tax altogether and replace it with a progressive federal sales tax on the consumption of goods and services [source: Gates].

Advertisement

This consumption-based tax would also replace payroll tax (like Social Security, Medicare and self-employment tax), gift tax, estate tax and even capital gains tax with a 23 percent sales tax. That means nothing taken out of your paycheck, no annual tax return to file, and no taxes on savings and investment earnings. The most comprehensive proposed national sales tax plan is known as the Fair Tax.

The Fair Tax is designed to encourage and reward high earners instead of overtaxing them. It does favor the wealthy, but the idea is that because wealthy people buy more, they will still be paying substantial taxes on big-ticket or luxury items. Meanwhile, investing in new business or charity would cost them nothing in taxes and help to strengthen the economy.

A Fair Tax could simplify the tax process for all Americans. There would be no complex deductions for the wealthy, but there would also be no tax credits to help lower income families. For those living at or near the poverty level, the Fair Tax proposal includes a "prebate" or upfront subsidy to help these individuals and families meet basic needs. Most everyone else would pay less than we do under the current system, proponents say, but the revenue generated would be the same — only much more stable.

Still, there are critics who say an overhaul of the U.S. tax system isn't viable. In this article, we'll take a look at how a Fair Tax or flat consumption tax would work – and why it might not actually happen.

Advertisement