On March 23, 2010, President Barack Obama signed into law a bill that will stand as one of the landmark achievements of his presidency and of health care reform in America. The much-embattled legislation had stirred up public protests, pundit vitriol and congressional dissent before becoming the first major legislative bill in modern U.S. history to pass against unanimous Republican opposition [source: Goodridge and Arnquist]. As it turned out, the fight was just starting.

Although it now stands as the capstone of a century-long effort to reform health care in the U.S., the Patient Protection and Affordable Care Act of 2010, which went into effect in 2014, began with the more modest goal of helping uninsured Americans. But as messages from insured middle-class families poured into Congress complaining of runaway premiums, illness-related cancellations and other issues, it gained both scope and momentum, culminating in the largest health care reform since Medicare in 1965 [source: Bash et al.].

Advertisement

In fighting the legislation, pundits and politicians pulled out all the stops. The most extreme rhetoric involved comparisons to Nazi Germany and invoked fictional "death panels" [sources: Mahnken; Snow et al.] More circumspect opponents voiced concerns over expanding federalism, government overreach and potential harm to private insurers.

The ACA narrowly survived political wrangling and squeaked by a 2012 Supreme Court challenge, but both contests left their marks. The former destroyed the ACA's public option component, which would have created a new government-run insurance program similar to Medicare. The latter, by a narrow majority, upheld some aspects of the law while weakening others. Further legal challenges loom.

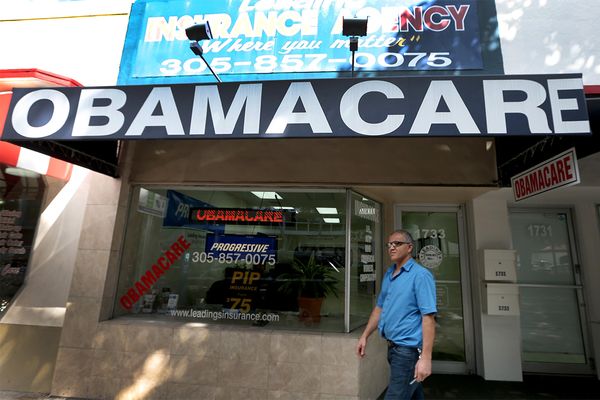

By November 2014, roughly 8-11 million people – 25 percent of uninsured Americans – had acquired health coverage, 7.3 million of them through online exchanges. Although 85 percent were eligible for federal subsidies to defray premiums, high deductibles and out-of-pocket costs remained an impediment for many [source: Goodnough et al.]. More are expected to sign up in future open enrollments, but just how many will depend on the number of states willing to expand Medicaid -- and how successfully the program gets the word out. As of late October 2014, only 1 in 10 uninsured Americans knew that the second open enrollment was about to start, and 23 states had declined to join in Medicaid expansion [sources: Sanger-Katz; Sanger-Katz].

Advertisement