You've probably said that you wish you had time to volunteer. Maybe you've had a few ideas about ways to make changes, but you can't stop and help today: you have to get to work or to class, or you have to take care of your family.

Imagine now that you can choose from a variety of positions in growing industries, jobs that would put you in contact with community leaders. You'll develop real world problem-solving skills and see the results of your efforts all over the country. Even if you have to put off college for a year, you'll go back to school focused and dedicated. Additionally, for your investment in the United States, government grants will help pay for your education. On the other hand, are your college years a distant memory as you're stuck in the 9-to-5 grind? Imagine that your company gets a tax break for encouraging you to take a paid leave of absence to volunteer full time.

Advertisement

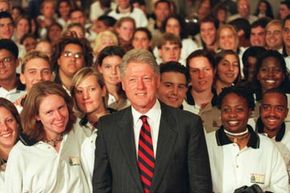

AmeriCorps is a federally funded service program, founded in 1993 by President Bill Clinton. Its goal was to solidify and unify national volunteer programs, based on the success and popularity of similar, internationally-focused initiatives like the Peace Corps. AmeriCorps applicants must be at least 17 years old (or 18, for some programs) and a U.S. citizen or a national or legal permanent resident. Each program has other specific requirements) [source: AmeriCorps]. The three umbrella programs are AmeriCorps State and National, focusing on immediate needs in communities across the country; AmeriCorps VISTA, which works with impoverished communities; and AmeriCorps National Civilian Community Corps, a residential program that develops long-term, team-based solutions to national issues. Each program is built of a network of smaller programs and specific projects, and more corps will be added in the near future [source: Corporation for National and Community Service, Herszenhorn].

The Segal AmeriCorps Education Award was implemented to encourage AmeriCorps alumni to pursue higher education. In 2006, the U.S. Senate renamed the award in honor of service pioneer Eli Segal, who helped found the Corporation for National and Community Service, (the organization that oversees AmeriCorps). The grant has demonstrated to be a powerful incentive to boost the program's recruitment efforts [source: EnCorps, Learn and Serve America]. AmeriCorps members receive the Segal AmeriCorps Education Award upon completion of their service term.

Read on to get a better understanding of how AmeriCorps can help with your educational aspirations.

Advertisement