Loan Cons

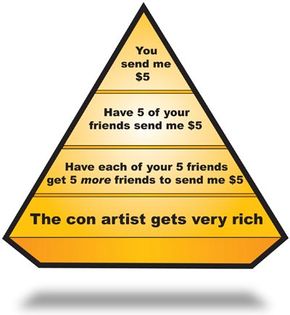

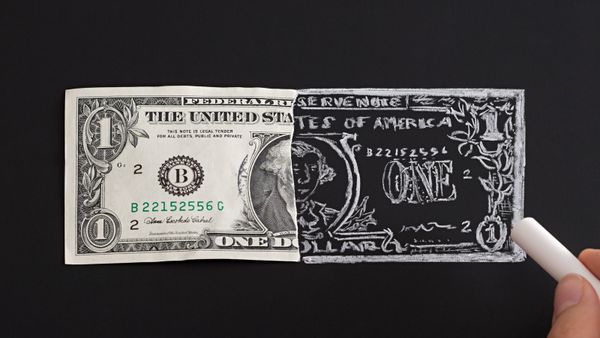

Mortgages, credit refinancing and other large loans are a major market for con artists. Some companies today offer "debt removal" services. They will provide you with a certificate that invalidates your mortgage or other debt, meaning you no longer have to pay for them, in return for a large fee. But the document they provide is worthless -- there are no legal loopholes that allow you to get out of debt without making the payments.

Con artist bankers may slip a page into a loan contract that says the bank now owns the home. The stack of paperwork the homeowner has to sign is mind-boggling, and he may overlook the fine print. Some people end up signing over their homes for nothing.

Mortgage refinance scams are rampant as well. These con artists prey on people who are already in financial trouble. The victim is typically having trouble making his mortgage payments. The con artist banker notices that the victim has some home equity, too much debt and not enough income. A loan is offered even though it is obvious the victim can never make the payments. That's OK with the con artist. He doesn't want the payments; he wants an easy foreclosure on a home.

How to Avoid a Con

Sometimes it seems like the world is full of people constantly trying to get their hands on your money. But there are a few things to remember that will help make you resistant to most cons:

- You never get something for nothing. There's an old saying: "You can't cheat an honest man." Most cons rely on the victim's own greed. Con artists know that people often throw caution to the wind when they start seeing dollar signs. Deals that sound too good to be true usually are.

- Guard your personal information. Especially guard your Social Security number, credit card numbers and bank account numbers. We have to use these numbers in many of our daily transactions, but if you are asked for any of this information, be absolutely sure that the person doing the asking is someone you can trust or works for a reputable company.

- Don't accept solicitations. Whether you get a cold call for an investment opportunity or someone comes to your door offering to do home repairs, hang up the phone and close the door. While there may be legitimate businesses that go door-to-door or make cold calls to find customers, they are few and far between.

- Watch for signs.Con artists often give themselves away if you ask enough questions. Ask for some kind of written documentation of their offer. Check for a real address, not a P.O. Box. Ask to see a driver's license, and write down the information on it. Write down license plate numbers, and make sure the con artist sees you doing it. If it's a legitimate offer, he won't mind. Tell him you need to think the deal over for at least a few days before making a decision. A con artist will often pressure you to make a decision on the spot -- often using hard sell tactics, such as saying that the deal won't last. They may get nervous when you ask for something in writing, and will usually refuse to provide it. When someone wants your money, if the offer is legitimate, it will still be around next week.

If You've Been Conned

The most street-wise person can get taken in by a con. If you've been victimized, what should you do?

Con artists count on their victims feeling foolish and afraid to report the scam. But if you remain silent about being conned, you're letting the con artist move on to steal from others. Write down every detail you can remember as soon as possible, while it's fresh in your memory. Collect any documented evidence you might have as well. This includes receipts, contracts or even your own phone records.

Now it's time to contact the authorities. You may have to do some legwork to find the right agency, or someone who is willing to help you. Your local police department may have a special division assigned to fraud cases. Also contact your local district attorney. Get in touch with the Better Business Bureau and see if there are any other reports of the same con artist -- this could help you and the police track him down. Many scams also fall under the jurisdiction of certain federal agencies, like the Federal Trade Commission and the Securities and Exchange Commission. If you really reach a dead end, try your local TV news stations. Many have segments where a reporter tracks down a con artist and demands answers, and con artists hate the spotlight.

For lots more information on con artists and related topics, check out the links on the next page.